what is hospital indemnity high plan

You can buy a. Childrens Specialized Hospital an RWJBarnabas Health facility is the nations leading provider of inpatient and outpatient care for children from birth to 21 years of age facing special health challenges from chronic illnesses and complex physical disabilities like brain and spinal cord injuries to a full scope of developmental behavioral and mental health concerns.

![]()

Group Hospital Indemnity Part Time

Every hospital indemnity insurance plan is different but Aflacs hospital insurance pays the policyholder cash benefits unless otherwise assigned.

. In the ongoing pandemic scenario health insurance plays a vital role in safeguarding your health as well as your wealth. Major Medical Protection covers costs of serious illnesses and injuries which usually require long-term treatment and rehabilitation period. Basic and Major Medical Insurance coverage combined are called a Comprehensive Health Care Plan.

All insurance policies and group benefit plans contain exclusions and limitations. Hospital indemnity coverage options vary according to different benefits that are offered and may also depend on what. Prior hospital confinement may be.

These benefits can be used to help pay for a variety of treatments and procedures related to hospital stays. METLIFES HOSPITAL INDEMNITY INSURANCE IS A LIMITED BENEFIT GROUP INSURANCE POLICY. Life other than GUL accident critical illness hospital indemnity and disability plans are insured or administered by Life Insurance Company of North America except in NY where insured plans are offered by Cigna Life Insurance Company of New York New York NY.

The Queen Elizabeth II Jubilee Hospital is a medium metropolitan adult facility providing a range of inpatient and outpatient services and a 24-hour emergency department. It pays a part of each medical service you receive such as a doctor visit or hospital stay. You pay the rest of the cost.

Tax benefits can be claimed against your health insurance premium. The policy or its provisions may vary or be unavailable in some states. Cnr Kessels Rd Troughton Rd Coopers Plains QLD 4108.

A fee-for-service insurance policy also called indemnity insurance is a traditional form of health insurance. Basic protection deals with costs of a hospital room hospital services care and supplies cost of surgery in or out of hospital and doctor visits. It helps you save tax under section 80D of the Income Tax Act 1961.

The policy is not intended to be a substitute for medical coverage and certain states may require the insured to have medical coverage to enroll for the coverage. Due to the high cost of hospitalization expenses it is important to have a medical insurance plan in place. For availability costs and complete.

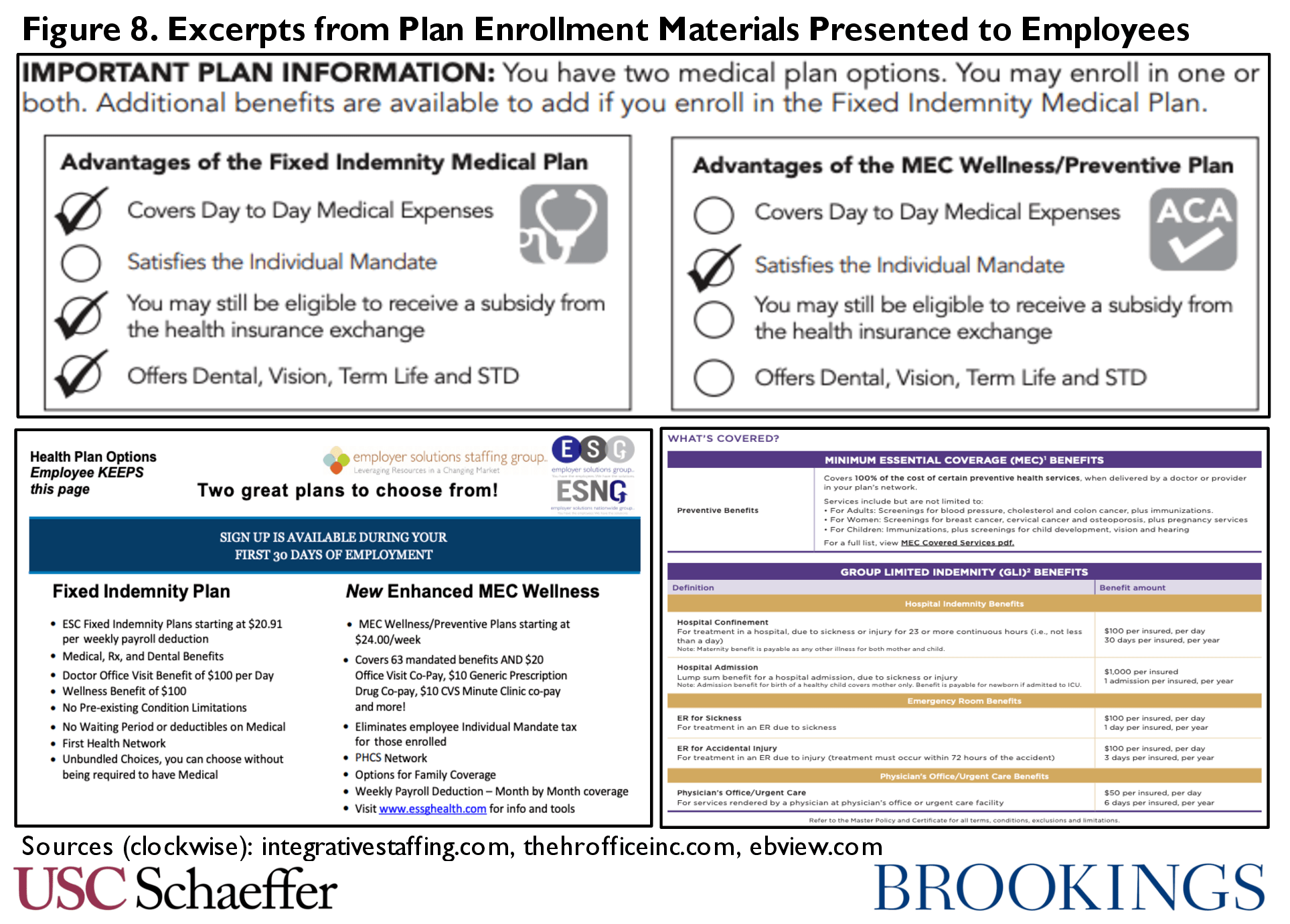

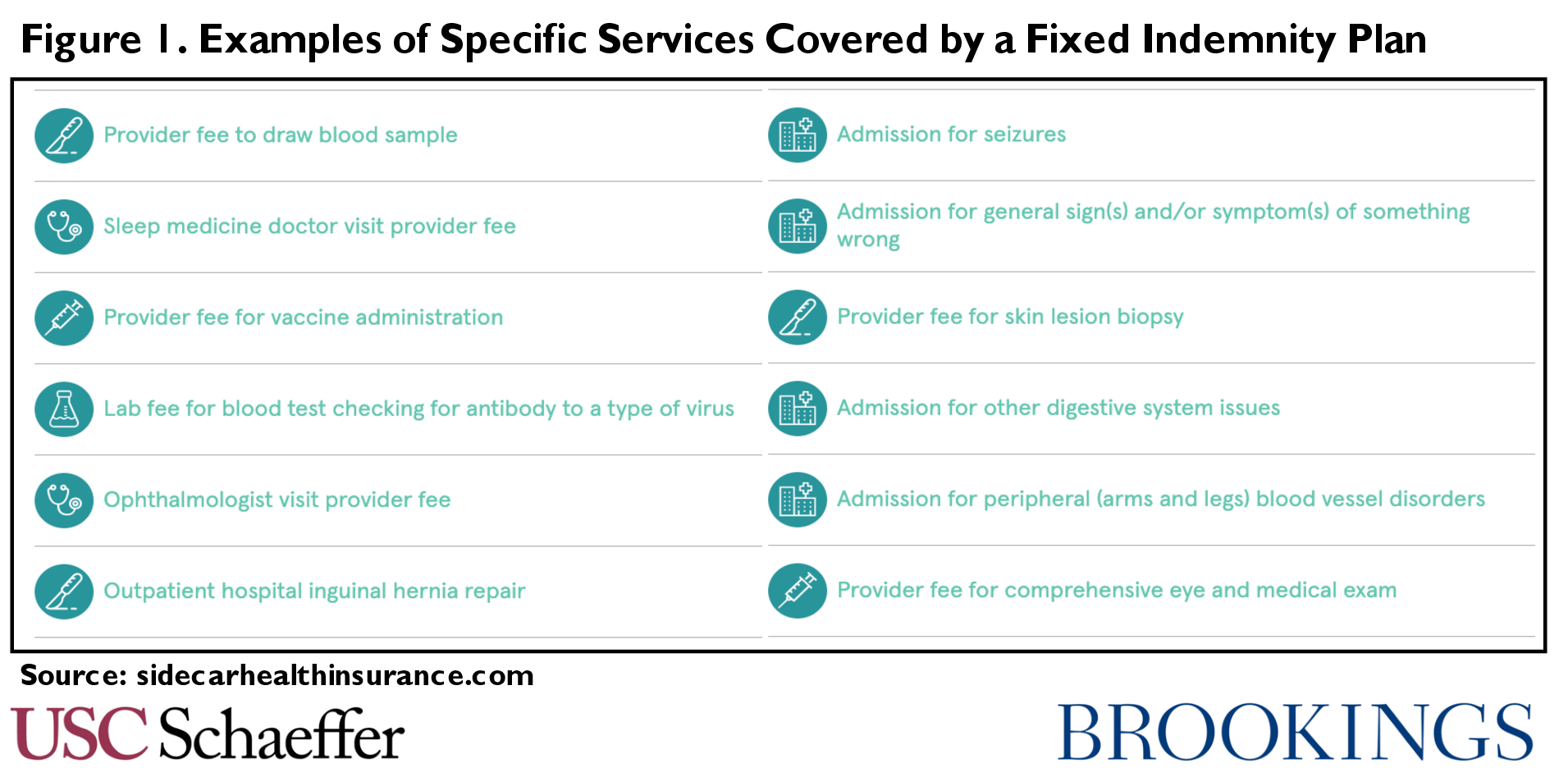

Fixed Indemnity Health Coverage Is A Problematic Form Of Junk Insurance Usc Schaeffer

The Ultimate Medicare Blog Medicare Plan Finder Health Care Coverage How To Plan Medicare

Sun Life Offers Hospital Indemnity Insurance With New Extended Hospitalization Coverage To Help Members Close Coverage Gaps Sun Life

What Is Hospital Indemnity Insurance And Do I Need It American Income Life Insurance Co

4 Facts You Need To Know About Hospital Indemnity Insurance

Fixed Indemnity Health Coverage Is A Problematic Form Of Junk Insurance Usc Schaeffer

Why Hospital Indemnity Insurance Should Be Part Of Every Coverage Portfolio Allstate Benefits